Archives

Deal Flow Management is Now Harder than Fundraising For #Microvc in India

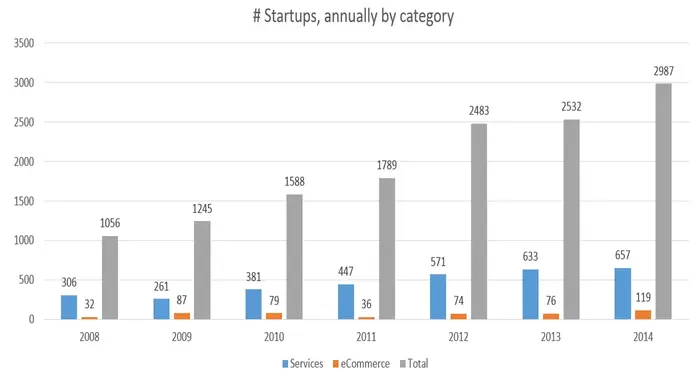

In 2008 (before Angel List) there were roughly 1000 technology startups in India starting each year. of these about 50+ got funded by VC each year according to Thomson Reuters.

The percentage of services (consulting, IT enabled services, BPO, outsourcing) companies was about 29% – those that started and 33% of those that got funded.

The number of eCommerce companies was about 3% of the total.

Fast forward to 2014 and those number of companies starting at 22% of the total for services and 5% of the total for eCommerce.

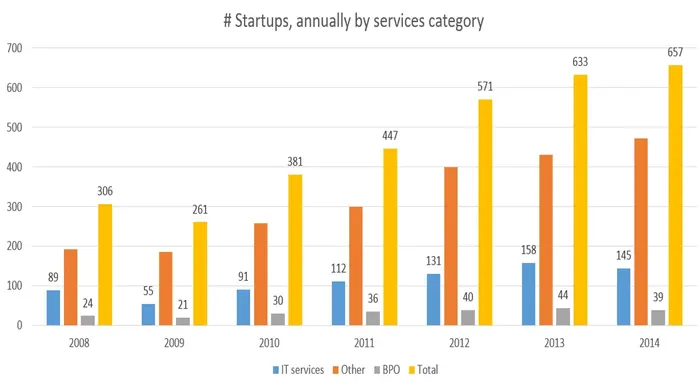

The structural changes of the services companies have changed as well. We have gone from 8% of the companies in IT Services to 5% from 2008 to 2014.

While Thomson Reuters does not break out the data, anecdotal evidence suggest that there are a lot more digital marketing & design outsourcing companies now than before.

The number of eCommerce companies has been steadily increasing as a % of companies started, but has increased significantly as a % of funded companies and a % of total funding.

The only other category, which has grown (for which I dont have a breakout again) is software as a service (SaaS).

Over the last 7 years, the number of Micro Venture Capital firms has also grown. We have gone from none in 2008 to 5 in 2014, and I think we will end up at about 10 Micro Venture Capital firms (those that have less than $25 Million in capital to invest) in 2015. These include Angel Prime, Oris, India Innovation Fund, Blume Ventures, and others.

I have talked to about 5-10 angel investors and industry veterans who are all looking to start their own Micro VC, seed fund and combination accelerator or incubator in India over the last 3-4 months.

In 2008, the average amount of time it took to raise a fund (regardless of size) was about 9 – 12 months. That number is lower for Micro VC funds, obviously, but we have no way to know how long it would have taken.

In 2011 of the 3 funds that raised, the average was about 7 months.

This year, I am hearing funds that are < $25 Million close their raise in less than 4 months.

That means the time taken to raise their fund has dropped. It is easier for fund managers to raise their capital, they can do it in shorter periods of time and they can raise more than they initially desired.

The challenge for the fund managers seems to be no longer raising capital, but efficiently deploying it.

The gold standard for VC investing has been proprietary deal flow (startups that come to the investor for funding exclusively and go to no other investors). That’s becoming harder for all VC’s now.

If the number of companies starting up has grown significantly (as from the graph above) and the % of non services companies have grown as well, then there is a real democratization of founding startups.

So the problem has now moved to sourcing, building a brand for your Micro VC firm and convincing entrepreneurs that you are the “smartest” capital available.

The best entrepreneurs have multiple sources of funding, and they have many investors of different type chasing them.

The challenge for Micro Venture firms with no brand visibility or “magnet” founders is that their deal flow is largely limited.

From our own data, I can confidently tell you the “best” deals are usually referrals, but 3 in every 5 companies we get into our program are non referrals. Speaking to Accel and Helion last week, I confirmed that 25% of their funded opportunities were cold (unsolicited).

So while the Micro VC fund manager may have a decent network, their biggest challenge is going to be that they will not be able to attract at least a quarter of deals which come because of having a good brand in the startup ecosystem.

The problem for a lot of the Micro VC’s is going to be that they have poor quality deal flow or deal flow that’s not proprietary.

While they will still go to many events, and review Angel List startups, I suspect they will have a tougher time getting good quality companies to apply.

The bottom line is that now it is as hard for the investors to get good companies as it is for the entrepreneurs to get good investors.

Which is why I love this quote –

“Every morning in Africa, a gazelle wakes up, it knows it must outrun the fastest lion or it will be killed. Every morning in Africa, a lion wakes up. It knows it must run faster than the slowest gazelle, or it will starve. It doesn’t matter whether you’re the lion or a gazelle-when the sun comes up, you’d better be running.”

― Christopher McDougall, Born to Run: A Hidden Tribe, Superathletes, and the Greatest Race the World Has Never Seen

Archives

How “Clustering Illusion” Stalls More #startups Than Any Other Bias

When you are doing your initial customer development, by talking to many potential users, there are many cognitive biases you need to be aware of.

Cognitive biases are tendencies to think in certain ways that can lead to systematic deviations from a standard of rationality or good judgment.

Usually most founders tend to solve problems they have exposure to or those they are aware of, or those they believe to be one that’s a large market. This stems from the “scratch your own itch” phenomenon.

I had a conversation with a founder who is building a consumer internet company, where viral effects of her product determine the growth trajectory more than any other metric. Or so, she had learned from many other founders experiences – both by talking to them and investors in the space.

After 3 months of building her mobile eCommerce product, she and her cofounder launched it in the marketplace. Initial traction was good and trending ahead of their expectations. Many of the early users were impressed with their product selection and merchandise.

Growth after the 4th month though, stalled as they were on the road trying to raise their initial funding. Most every entrepreneur knows that fund raising can be a full time job. In fact I have mentioned several times that fundraising is a poker game more than chess.

When they were trying to show their initial user growth, many investors had the same problem – was their product a trendy, 3-month-uptick or a sustainable-fast-growth business?

After hearing this from the 5th seed investor, they determined that they need to look closer at their numbers, their repeat purchase behavior and address the issue before they were going to raise any funding.

Looking at the initial numbers suggested their they had many buyers who got to know about them through word-of-mouth, and the repeat purchase was high.

She and her cofounder determined that they had to improve their virality coefficient.

This is the bias I see most often: clustering illusion.

The clustering illusion is the tendency to erroneously consider the inevitable “streaks” or “clusters” arising in small samples from random distributions to be statistically significant.

When you have very little data, you have very little data. That’s it.

Don’t make assumptions about the overall market based on very little data.

There are times when you have 60% of the data and you have to make a decision. There are times when you have 30% data and you have to make a decision.

The difference between 30% and 60% is a lot. In fact, most entrepreneurs I deal with confuse having 3% of data with 30% of data.

To reduce clustering illusion the only remedy is to get more data. You will have to run more, smaller, experiments, over smaller periods of time and do it consistently. Make your assumptions, document your hypothesis, but continue to work on getting more data.

Turns out the real problem for our entrepreneur was that the overall market was much smaller, and they found it after 1 year of trying to increase their virality coefficient. They did raise their initial funding, but have since pivoted to expand their merchandise offerings to cater to a larger market.

Archives

How to name your SaaS pricing plans? A primer from 89 examples

There are over 7500 SaaS companies according to angel List. Over the last few weeks I had a chance to review 89 of the companies to understand their free to paid conversion and also a chance to talk to 13 companies. What I learned was that time spent on the pricing page was a key indicator of conversion and you can A/B test your pricing page for colors, position of your highest and lowest prices, number of plans showed, feature listing and your call to action.

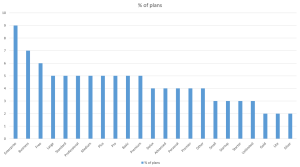

I did notice that of the 89 companies, 82 of them gave their pricing plans “names”. Each plan had a name so their customers could associate the name with the plan. Most (over 80%) used standard and conventional names but it was interesting to see the spread. Here is the data from 89 companies and 251 plans.

The most important points you want to take away are the following:

1. Even though SMB and SOHO (Small Office, Home Office) users are the first few to sign up for a SaaS service, 3 of the top 5 names were named Enterprise and Business and Large. I would imagine this has to do more with the inside out naming (the plan is large or enterprise, not the company buying it).

2. The plans named “Small or equivalent” were largely in the bottom quartile of the distribution. Even though over 70% of companies had 3 plans, only 35% of them named the smallest plan as “Startup”, “Starter” or “Lite”. The most common starting plan was named “Standard”.

3. Of the 20% of companies that used “custom” names like Boutique, Tyrannosaurs, or Garden named all their plans uniquely. The surprising element of the companies that used custom names was that most of them had images to convey the “size” of the plan.

There were some other surprising things I learned as well in my discussions.

1. In naming plans, understanding the end customer’s billing and invoicing was key. Most customers got an email invoice (a few sent PDF invoices) and they would either file them or expense those invoices (if < $50) or would send the invoices to an accounting team.

Ensuring that the “accounting” team did not ask any questions was the consistent mention among 3 of the startups with custom names for plans.

2. Naming the plans to support your payment gateway is also critical. Getting too cute with names means the payment gateway will support a higher refund request that were marginal.

3. Many of the companies had to setup standard names so their marketing and product management teams could do better analytics and research on the backend, consistent with their reporting. Surprisingly, if the names were “standard” the companies found it easier to have a conversation to understand conversion rates, pricing options and changes with their finance teams, design teams and other outsourced companies as well.

Archives

Creating Artificial Constraints as a Means to Innovation

Many of the entrepreneurs I know have created new innovative startups thanks to real constraints they had. For example, I was hearing AirBnB’s Brian Chesky, on the Corner Office podcast and he mentioned that when he and his cofounder were trying to get some money to get started and the only way to keep afloat was to “rent” their air bed they had in their room. That, then led to Air Bed and Breakfast, which is now AirBnB.

This was a real constraint they had – no money to “eat” so they had to make it happen somehow.

I have heard of many stories of innovation where in the protagonists had real constraints of either financial, technology, supply, demand, economic, social or any number of other characteristics.

The interesting story that I have also recently heard of how Facebook has “pivoted” from being a desktop offering to getting a significant part of their revenue from mobile is how they were given the arbitrary constraint of only accessing Facebook via the mobile phone.

So there are ways that you can create “artificial” constraints to force innovation to happen.

Most larger companies and some smaller ones as well, have to constantly find ways to create artificial constraints – to find a way to innovate and be more be a pioneer.

While some constraints are good – lack of funds at the early stage for example and lack of resources, there are entrepreneurs that are stymied by these constraints and those that will find a way to seek a path to go forward.

I think this is a great way for you to think about innovating in a new space. If you have constraints, find a way to use it to your advantage.

-

Business2 days ago

Business2 days agoWhat I Learned in My First Month of Running a Startup Accelerator

-

Business3 weeks ago

Business3 weeks ago5 Profitable Digital Business Ideas, Increase Your Income!

-

Archives3 months ago

Archives3 months agoHow Can You Tell If An Angel Investor Is “real” Or “fake”?

-

Business1 month ago

Business1 month agoIndividually Proficient, Collectively Efficient; Why Your First Hire Matters

-

Business2 hours ago

Business2 hours ago6 Affordable Co Working Space around the Globe

-

Business2 hours ago

Business2 hours ago6 How to Make a Business Presentation More Relatable

-

Politics1 month ago

Politics1 month agoPrediction of Global Economy in 2024, Indonesia The First ASEAN Country Most Confident to Create This Program

-

Archives1 month ago

Archives1 month agoHow Accelerators Make Money To Manage Operating Costs