Archives

The “two Speed” State Of Indian Market Adoption

I have been watching / following 7 startups (3 in eCommerce, 2 in SaaS and 2 in consumer Internet) that target the Indian market over the last 14-18 months. All the entrepreneurs approached me with an intent to get seed funding so I had a chance to go over their traction, progress and future projections.

I have formulated a theory of market adoption of products / high technology products in India which I have tested with these and other companies and also with several venture investors.

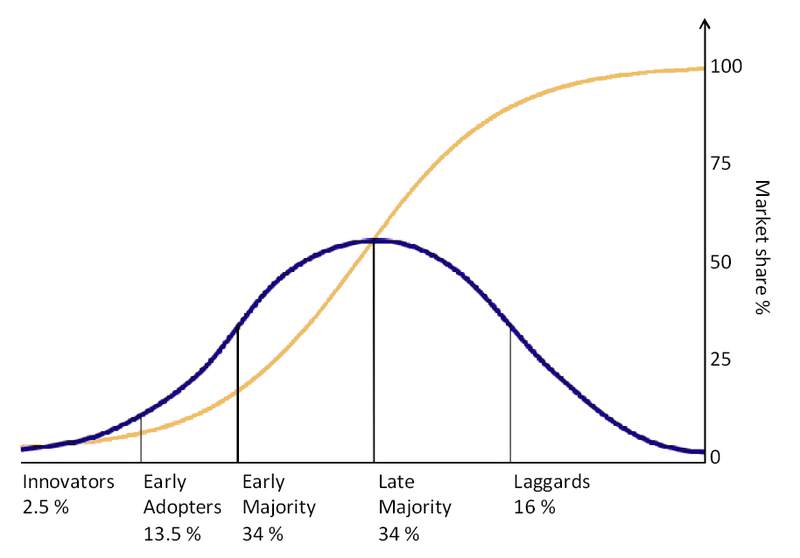

For background please read “Diffusion of innovations” by Everett Rogers and Crossing the chasm by Geoffrey Moore. Don’t worry, I have only linked to their Wikipedia page, so it wont cost you anything.

At the top of the consumption (and monthly income) pyramid in India are what economists and marketing people call the SEC A and B class who have enough disposable income to spend on innovative new products. For the purposes of this blog post I am going to use 10 Mill (SEC A) + 20 Million (SEC B) households as the target.

The Innovators (less than 1 % of the population or 12 Million individuals) in India (entrepreneurs mostly) who conceive and develop these products for the Indian market and the early adopters (less than 5% of population or approx 60 Million individuals) together make up the entire “early adopter” category. Unfortunately less than 30% of them have both the interest, and the desire to be early adopters of technology.

Indian markets do not follow traditional diffusion characteristics when first innovators buy, then early adopters, then the early majority, and then the late majority and finally the laggards.

My theory on how diffusion of innovations works in the Indian context is as follows.

In India there are only 2 market adopters – those that are early and those that are not.

Abhijeet calls it the “low hanging fruit” and then everyone else.

So lets look at the implications of this observation / theory.

So what does that mean for entrepreneurs?

You will see a “headfake” of adoption and then a taper off.

E.g. The B2B SaaS company will quickly (within 3-6 months) get 10+ customers and over 30 in the pipeline, only to find the next 50 and the next 100 or the next 1000 are either non-existent or will come in 3-6 years.

E.g. The eCommerce company will see 1 -3 Million “registered” users and 1000’s of transactions within 12 months and find that the next 1000, 5000 and 10,000 transactions take 4-5 times as long.

E.g. You will see an initial 20,000 users for your mobile application for social TV extremely quick (within 3-6 months) and the next 50,000 or 100,000 take you the next 3-6 years.

I have seen these numbers play out again and again to know there are exceptions but those are rare.

These numbers are also dramatically different than those of companies targeting US or other markets.

When should you (as the entrepreneur) raise money?

You should raise it at the peak of inflated expectations. I.e. After you have some traction, which the investors think will be long lasting, steady and rapid. You will get the best valuation for the company at that time. Once your investor has some “skin in the game”, they are in to get their money back and then some, so they will do all it takes to make you successful.

What does this mean for investors?

The best time to invest is either very early (starting to build a company, idea and team stage) OR at the trough of disillusionment stage.

If they are early, you will get the bump from the initial adoption, so the value of the company increases many fold before the next round (which you should help the company raise at the peak of inflated expectations.

If you are post the trough, then you benefit from a growth stage.

What makes you go over the trough to the slope of enlightenment?

In my experience:

TIME

Nothing else.

You may think I am being facetious, but I am serious.

This may be a cultural thing, but in India, over time if you have the ability, patience and willingness to survive, you will reach the plateau of productivity.

Anecdotal evidence over several sales transactions also suggests to me that once people in India see you around for 2-3 years, they think “Okay, this company / person is for real. We should give her / the product a shot”.

Big thanks to Abhijeet and Shekhar for helping me with their data points to reinforce my theory.

Read Also: The Indian Startup Ecosystem Should Look At Israel As A Role Model

Archives

Creating Artificial Constraints as a Means to Innovation

Many of the entrepreneurs I know have created new innovative startups thanks to real constraints they had. For example, I was hearing AirBnB’s Brian Chesky, on the Corner Office podcast and he mentioned that when he and his cofounder were trying to get some money to get started and the only way to keep afloat was to “rent” their air bed they had in their room. That, then led to Air Bed and Breakfast, which is now AirBnB.

This was a real constraint they had – no money to “eat” so they had to make it happen somehow.

I have heard of many stories of innovation where in the protagonists had real constraints of either financial, technology, supply, demand, economic, social or any number of other characteristics.

The interesting story that I have also recently heard of how Facebook has “pivoted” from being a desktop offering to getting a significant part of their revenue from mobile is how they were given the arbitrary constraint of only accessing Facebook via the mobile phone.

So there are ways that you can create “artificial” constraints to force innovation to happen.

Most larger companies and some smaller ones as well, have to constantly find ways to create artificial constraints – to find a way to innovate and be more be a pioneer.

While some constraints are good – lack of funds at the early stage for example and lack of resources, there are entrepreneurs that are stymied by these constraints and those that will find a way to seek a path to go forward.

I think this is a great way for you to think about innovating in a new space. If you have constraints, find a way to use it to your advantage.

Archives

The Great Mobile App Migration of March 2020

Over the last few weeks as many in the world have been in lockdown, there has been a temporary “mobile app migration” happening. There are new apps downloaded and they replaced existing apps on the “home screen”.

While some of these apps are likely temporary use, for e.g. I have 6 “conferencing apps” – Zoom, Uber Conference, Webex, Google Hangouts, Blue Jeans and Goto Meeting. That is because of the many people I have conference calls with – each company seems to have chosen a different web conference solution.

Other apps seem like they will have staying power – Houseparty, for e.g. which has games, networking and video conferencing all built into one app to keep in touch with friends and relatives.

The apps that have moved away from my “home” screen, which I expect will come back once the crisis will be behind us include – Uber, Lyft and all the airline apps from Delta, Alaska and United.

Archives

Perseverance with the Ability to Pivot on Data: 21 Traits We Look for in Entrepreneurs

There are 5 key inflection points I have noticed which makes founders question their startup, to either make a call to continue working on their startup, pivot to a new problem or quit their startup altogether.

It is at these points that you really get to know the startup founder and their hunger and drive to be successful. I don’t think I can characterize those that choose to quit as “losers” or “quitters” because of many extraneous circumstances, but there is a lot of value that most investors see in entrepreneurs who face an uphill part of their journey to come out on the other side more confident and stronger.

These five inflection points are:

- When you have to get the first customers to use and pay for the product you have built after you have “shipped” an alpha / beta / first version. Entrepreneurs quit because they have not found the product-market-fit – because the customer don’t care about the product, there is no market need, or the product is really poorly built, or a host of other reasons.

- When you have to start to raise the first external round of financing from people you are not familiar with at all. Entrepreneurs quit because while it is hard to get customers and hire people, it is much more harder to get a smaller set of investors to part with their money, if you do not have “traction”, or “the right management team” or a “killer product”.

- When you have to push to break even (financially) and sustain the company to path of being self sufficient. Entrepreneurs quit at this stage because they have now the ability to do multiple things at the same time – grow revenues and manage costs, and many of them like to do one but realize it is hard to do that without affecting the other. So, rather than feel stuck they decide to quit.

- When you have to scale and grow faster that the competition – which might mean to hire faster, to get more customers, to drive more sales, or to completely rethink their problem statement and devise new ways to grow faster. Entrepreneurs quit at this point because they are consumed by the magnitude of the problem. They overassess the impact the competition will have on their company, give them too much credit or focus way too much on the competitors, thereby driving their company to the ground.

- At any point in the journey, when the founders lose the passion, vision or the drive to succeed. Entrepreneurs quit a these points because they have challenges with their co founder, they don’t agree with the direction they have to take, or encounter the “grass is greener on the other side” syndrome.

While I have observed many entrepreneurs at these stages at discrete points in time, I have also had the opportunity to observe some entrepreneurs in the continuum, and I am going to give you my observations on 3 of the many folks I have known, who, have quit.

One went back to college to finish his MBA after getting a running business to a point of near breakeven, another found the business much harder than he originally thought he would and got a job at a larger company and the third was just unable to have the drive to go past 11 “no’s”‘ from angel investors.

Over the last 8 years, if I look at my deeper interactions with over 90 entrepreneurs, who I would have spent at least 100+ hours each, I would say that of the 24 people that are not longer in their startup, the one thing that stands out among the ones that persevere is that it is not “passion” or “vision” at all.

It is the inherent belief that they are solving a problem that they believe is their “calling”. They also don’t believe that there is any other problem that’s worth solving as much, even though there may be easier ways to make money.

So most of my questions of entrepreneurs to test whether they will pivot or quit are around why they want to solve this problem (which I am looking to see if they know enough about in the first place) versus any other one.

The answer to that question is the best indicator I have found to be the difference between the pivots, the leavers and the rest.

-

Business2 hours ago

Business2 hours agoWhat I Learned in My First Month of Running a Startup Accelerator

-

Business2 weeks ago

Business2 weeks ago5 Profitable Digital Business Ideas, Increase Your Income!

-

Archives3 months ago

Archives3 months agoHow Can You Tell If An Angel Investor Is “real” Or “fake”?

-

Business1 month ago

Business1 month agoIndividually Proficient, Collectively Efficient; Why Your First Hire Matters

-

Business7 years ago

Business7 years ago6 Affordable Co Working Space around the Globe

-

Politics4 weeks ago

Politics4 weeks agoPrediction of Global Economy in 2024, Indonesia The First ASEAN Country Most Confident to Create This Program

-

Business7 years ago

Business7 years ago6 How to Make a Business Presentation More Relatable

-

Archives4 weeks ago

Archives4 weeks agoHow Accelerators Make Money To Manage Operating Costs