Archives

How “Clustering Illusion” Stalls More #startups Than Any Other Bias

When you are doing your initial customer development, by talking to many potential users, there are many cognitive biases you need to be aware of.

Cognitive biases are tendencies to think in certain ways that can lead to systematic deviations from a standard of rationality or good judgment.

Usually most founders tend to solve problems they have exposure to or those they are aware of, or those they believe to be one that’s a large market. This stems from the “scratch your own itch” phenomenon.

I had a conversation with a founder who is building a consumer internet company, where viral effects of her product determine the growth trajectory more than any other metric. Or so, she had learned from many other founders experiences – both by talking to them and investors in the space.

After 3 months of building her mobile eCommerce product, she and her cofounder launched it in the marketplace. Initial traction was good and trending ahead of their expectations. Many of the early users were impressed with their product selection and merchandise.

Growth after the 4th month though, stalled as they were on the road trying to raise their initial funding. Most every entrepreneur knows that fund raising can be a full time job. In fact I have mentioned several times that fundraising is a poker game more than chess.

When they were trying to show their initial user growth, many investors had the same problem – was their product a trendy, 3-month-uptick or a sustainable-fast-growth business?

After hearing this from the 5th seed investor, they determined that they need to look closer at their numbers, their repeat purchase behavior and address the issue before they were going to raise any funding.

Looking at the initial numbers suggested their they had many buyers who got to know about them through word-of-mouth, and the repeat purchase was high.

She and her cofounder determined that they had to improve their virality coefficient.

This is the bias I see most often: clustering illusion.

The clustering illusion is the tendency to erroneously consider the inevitable “streaks” or “clusters” arising in small samples from random distributions to be statistically significant.

When you have very little data, you have very little data. That’s it.

Don’t make assumptions about the overall market based on very little data.

There are times when you have 60% of the data and you have to make a decision. There are times when you have 30% data and you have to make a decision.

The difference between 30% and 60% is a lot. In fact, most entrepreneurs I deal with confuse having 3% of data with 30% of data.

To reduce clustering illusion the only remedy is to get more data. You will have to run more, smaller, experiments, over smaller periods of time and do it consistently. Make your assumptions, document your hypothesis, but continue to work on getting more data.

Turns out the real problem for our entrepreneur was that the overall market was much smaller, and they found it after 1 year of trying to increase their virality coefficient. They did raise their initial funding, but have since pivoted to expand their merchandise offerings to cater to a larger market.

Archives

What If You Were Given 10x The Amount Of Money You Wanted To Raise?

I had an interesting discussion with an entrepreneur friend yesterday. She has a consumer Internet (Curated marketplace) startup, which she has been working on since Jan. She soft launched it in May and has been seeing a doubling of revenue every 2 weeks so far. She is on the fund raising circuit and has a few interested people.

After a quick 30 min on her market segments, the traction and her supplier base, I was very keen to invest myself. She’s a very talented entrepreneur and passionate engineer, so I was a little concerned that she did not have anyone from the domain on her team. So, I demurred, asking her to connect with a few other folks I invest with.

One of the investors I talked to asked me how much she was looking to raise. I mentioned she was looking for about $500K.

“Why not $5 Million and go big”? was his question.

I started to offer some “rational” arguments as to why not – first, she did not have enough traction to justify a $8 – $10 Million valuation, she would not know what to do with the money, she was still trying to form her team, but I was thinking at the back of my head – “What if’?

What if investors did give you 10X the money you were asking for?

I understand that’s rare and largely impossible for most entrepreneurs to get, but what if?

So, I did a quick thought experiment with my entrepreneur friend and asked her to think, but not spend too much time modelling what her investments and metrics would be at $5 Million invested in the company.

At first, she was excited and said she could use all that money to hire people, expand into SF and other cities, etc.

A good 15 minutes later, she called back, much sober and asked – what % of the company would she have to give up for that kind of money – I said I did not know but suspected it would be 60-70% at this stage given the risk. Maybe if she was lucky, 50%. Again, I did not know, but I doubted that she would be able to get away with less.

After 30 more minutes, she called again, now asking me for the metrics that she’d have to hit. I thought she would not ask me that question, but I am glad she did. As an investor I wanted to have 5X to 10X return in 18-24 months, so I said she’d have to be at $50 Million to $100 Million valuation within 18-24 months.

She was doing $1000 per month. Even if we gave her a rich valuation, she’d have to be at $2 – $3 Million revenue per month in 18 – 24 months I thought.

She then pulled back.

Nope, she said. She was happy with raising $500K. Much less money, much more control, but much less stress.

I think we learned a lot from this thought experiment.

What would you do?

I dont think there’s a single person who would not expect more money (as investment) to mean more stress, but that’s the nature of the business.

You can work your way into it, or work towards your goal. Either ways, it is a lot of work.

Archives

The “two Speed” State Of Indian Market Adoption

I have been watching / following 7 startups (3 in eCommerce, 2 in SaaS and 2 in consumer Internet) that target the Indian market over the last 14-18 months. All the entrepreneurs approached me with an intent to get seed funding so I had a chance to go over their traction, progress and future projections.

I have formulated a theory of market adoption of products / high technology products in India which I have tested with these and other companies and also with several venture investors.

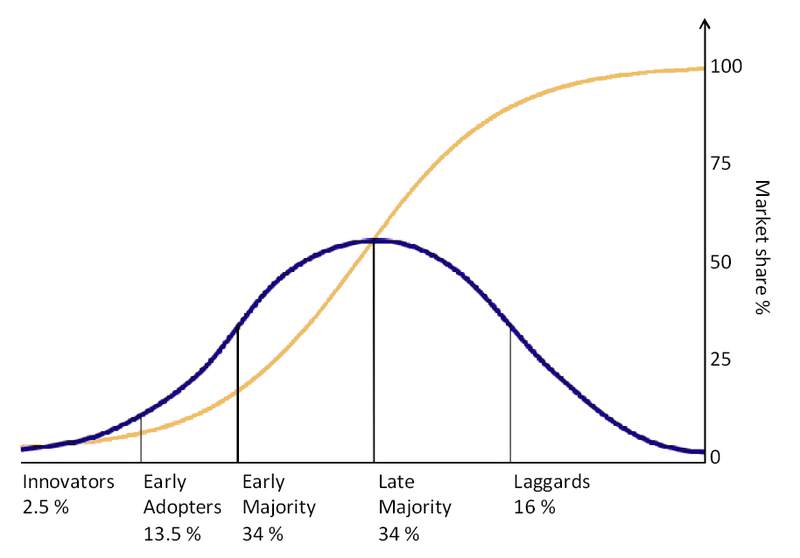

For background please read “Diffusion of innovations” by Everett Rogers and Crossing the chasm by Geoffrey Moore. Don’t worry, I have only linked to their Wikipedia page, so it wont cost you anything.

At the top of the consumption (and monthly income) pyramid in India are what economists and marketing people call the SEC A and B class who have enough disposable income to spend on innovative new products. For the purposes of this blog post I am going to use 10 Mill (SEC A) + 20 Million (SEC B) households as the target.

The Innovators (less than 1 % of the population or 12 Million individuals) in India (entrepreneurs mostly) who conceive and develop these products for the Indian market and the early adopters (less than 5% of population or approx 60 Million individuals) together make up the entire “early adopter” category. Unfortunately less than 30% of them have both the interest, and the desire to be early adopters of technology.

Indian markets do not follow traditional diffusion characteristics when first innovators buy, then early adopters, then the early majority, and then the late majority and finally the laggards.

My theory on how diffusion of innovations works in the Indian context is as follows.

In India there are only 2 market adopters – those that are early and those that are not.

Abhijeet calls it the “low hanging fruit” and then everyone else.

So lets look at the implications of this observation / theory.

So what does that mean for entrepreneurs?

You will see a “headfake” of adoption and then a taper off.

E.g. The B2B SaaS company will quickly (within 3-6 months) get 10+ customers and over 30 in the pipeline, only to find the next 50 and the next 100 or the next 1000 are either non-existent or will come in 3-6 years.

E.g. The eCommerce company will see 1 -3 Million “registered” users and 1000’s of transactions within 12 months and find that the next 1000, 5000 and 10,000 transactions take 4-5 times as long.

E.g. You will see an initial 20,000 users for your mobile application for social TV extremely quick (within 3-6 months) and the next 50,000 or 100,000 take you the next 3-6 years.

I have seen these numbers play out again and again to know there are exceptions but those are rare.

These numbers are also dramatically different than those of companies targeting US or other markets.

When should you (as the entrepreneur) raise money?

You should raise it at the peak of inflated expectations. I.e. After you have some traction, which the investors think will be long lasting, steady and rapid. You will get the best valuation for the company at that time. Once your investor has some “skin in the game”, they are in to get their money back and then some, so they will do all it takes to make you successful.

What does this mean for investors?

The best time to invest is either very early (starting to build a company, idea and team stage) OR at the trough of disillusionment stage.

If they are early, you will get the bump from the initial adoption, so the value of the company increases many fold before the next round (which you should help the company raise at the peak of inflated expectations.

If you are post the trough, then you benefit from a growth stage.

What makes you go over the trough to the slope of enlightenment?

In my experience:

TIME

Nothing else.

You may think I am being facetious, but I am serious.

This may be a cultural thing, but in India, over time if you have the ability, patience and willingness to survive, you will reach the plateau of productivity.

Anecdotal evidence over several sales transactions also suggests to me that once people in India see you around for 2-3 years, they think “Okay, this company / person is for real. We should give her / the product a shot”.

Big thanks to Abhijeet and Shekhar for helping me with their data points to reinforce my theory.

Read Also: The Indian Startup Ecosystem Should Look At Israel As A Role Model

Archives

The Coming 20+ Year Disruption In Higher Education

This is a post on the problems & solutions in higher education from someone clearly not qualified to make those observations. The only information I have is the 79 pitches from entrepreneurs large and small who are all trying to disrupt Higher Education from around the world. Besides that over 500+ articles, blog posts & discussions with several professors at the top colleges in the world.

The Higher Education market is largely a US dominated one. With over 4500 private, public and semi-public colleges and universities, this market is over $475 Billion. Over 9% of US GDP and close to $1.3 Trillion (pdf) is spent on education overall. While there is more spent on K-12 education, the higher ed market has more spend per student.

Most of the money spent by students in on tuition. Over 57% of the higher ed spend is on tuition. This goes towards educators, libraries, textbooks, facilities, etc.

The average 4 year college cost is reaching $30K+ per year for private colleges. Given that over 70% of US students end up with over $30K in debt after college, this clearly unsustainable.

With the advent of MOOC (Massive Online Open Courses) I personally believe it is only a matter of time before many of the 4500 colleges shut down. I personally think 50% of colleges in the US will close down in 10+ years. Similar for Indian colleges – over 50% of colleges in India will shut down in 20 years.

Most private colleges make money from endowments, grants, and then from tuition – in that order. Most of the moneyed institutions have “rich” students who then become alumni and donate to the college, many of the smaller colleges dont.

The average private college takes 2000+ students and charges about $30K per student. Lets say that is $60 Million per year.

Now imagine that the private college wants to take 20,000 students (online) instead. [They could also take 100,000 students, since nothing is going to stop them from doing that]. All things being equal and factoring in inflation, and the cost to run the university being largely the same, they would be able to charge $3K per student per year and still do well.

It is not a dream. It is going to happen. In 10-20 years, or likely sooner, but it is going to happen.

Would you rather get a degree from MIT and be taught by the top professor at MIT or a local college professor who may not have the level of depth and knowledge about the subject as the MIT professor?

You can do this from Saudi Arabia, Australia and India. That’s because even the folks in Newton, Mass, who live <100 Miles from MIT will be doing the same.

Most learning is going online. In a massive way. Higher education is as well.

Now, I understand the concerns.

A) The Internet do not replace the interaction you get in a face-to-face setting.

B) How can you build relationships with your students and network with them – which is the biggest value of a college 10 years hence? and

C) Online learning is still largely unproven.

All that will get itself sorted out with other offerings to supplement the MOOC.

In the future you will have interactions (office hours) remotely managed by professors.

In the future you will learn from your peers together as much as you will from the professor – which will build the relationships.

In the future you will have more teaching aids and tools to help you sort, identify and collate your learning better than textbooks.

That future is less than 10 years away.

I am going to shift gears and now try to talk to future parents.

What should you do? What are the things you can do to make sure your kids are going to be successful? This is primarily if your kids are between 0-10 years old.

First and (I cannot understate this) let your kids find their way.

If you can make the investment, buy them a tablet and let them learn stuff using the machine.

If you can get them to follow structure courses online (for older kids), I’d recommend Khan academy and other sites like those.

We dont have Television at home, but I am not convinced that’s the right approach for everyone. If you can get rid of the television, do it. I’d highly recommend it.

Kids will play more games than use the tablet for useful stuff initially but that novelty wears off in a few years. The % of core gamers and those that are addicted to gaming is still small. I am not saying ignore it, but be less worried about that than no exposure to games at all.

I dont think most parents will give up the school environment all together, since they need the kids to be “someplace” other than home when they head to work, but I would focus a lot less on grades at school.

In fact, grades will become irrelevant in 15 years, increasingly replaced by “show me what you did” instead of “how did you learn”. Why?

If you are MIT or Stanford and you want 20K students to take your course, you are likely to get less picky a decade from now.

[Side note: Similar to startups these days, when being evaluated by investors, the focus is on product & traction, not on idea, grades tell me how you studied, not what you learnt].

The goal of these colleges will go away from “exclusivity for some” to “knowledge for all” very soon. That’s the direction they are all heading. Will MIT as an institution or the lecture halls go away? – not likely. They will be the purview of the few rich kids who can spend $100K per year to be housed in 5 star luxury comforts. For the rest of us, a computer and an internet connection will suffice.

This next paragraph is going to unsettle a few folks, but hear my argument.

Focus on spending money *now* to help your kids, than saving money for the future. Most parents I know end up trying to save for education – by putting money in 529 plans, education savings plans and the like. I would use as much money you plan to save for the future into their education right now. Give them any edge they can get now and you will end up spending 1/3rd of what you originally planned for later.

That’s because the cost of higher education is going to drop dramatically for most students.

So who will hurt from these disruptions?

1. University deans, college presidents and the endowment chairs, who make over $1 Million per year.

2. Smaller unknown colleges who will see their enrollments drop dramatically and will likely have to shut down.

3. 529 plan administrators.

For the rest of us, quality higher education is going to be highly accessible.

Also Read: 5 Steps To A Good Market Analysis For Your Startup

-

Business3 weeks ago

Business3 weeks ago5 Profitable Digital Business Ideas, Increase Your Income!

-

Business5 days ago

Business5 days agoWhat I Learned in My First Month of Running a Startup Accelerator

-

Archives3 months ago

Archives3 months agoHow Can You Tell If An Angel Investor Is “real” Or “fake”?

-

Business1 month ago

Business1 month agoIndividually Proficient, Collectively Efficient; Why Your First Hire Matters

-

Business3 days ago

Business3 days ago6 Affordable Co Working Space around the Globe

-

Business3 days ago

Business3 days ago6 How to Make a Business Presentation More Relatable

-

Archives1 month ago

Archives1 month agoHow Accelerators Make Money To Manage Operating Costs

-

Archives1 month ago

Archives1 month agoThe Reason Why #Startups Fail in India