Archives

The Top 5 Things You Need to Do After You Hire Your First #Salesperson at Your #Startup

After the initial 5 or so customers and exhausting your personal network, and having product market fit, you are likely to look outside and hire your first sales person. Here are the top 5 things you need to do before, during and after you hire that individual.

1. Ensure you have set the right expectations for yourself, cofounders and the new sales person. If the sales process is long, dont expect the sales person to make it any faster initially. If you have no leads to start them off, dont expect them to bring a pipeline and if your customers are expecting a POC and trial before they are willing to consider purchase, dont expect the sales person to be able to close a sale before they experiment.

You should also have the expectation that the sales person will take 2 times your average sales cycle to build their sales pipeline. So if your average deal takes 3 months, expect them to take 6 months to get their pipeline “filled“.

I am often surprised at how much entrepreneurs and cofounders expect from a new sales person, if they have not been able to close an opportunity themselves. They often assume that since the sales person is a “professional” they will make magic happen. That’s highly unlikely.

2. Document and help the new person understand the sales process as well as you can. A blow-by-blow account of every activity in the sales process is better than a top level set of steps.

This step is very useful to also understand what you need to provide in terms of sales tools, marketing materials and collateral, to the sales person to make them successful during the sales process. If the 2nd meeting requires a demo, have it ready. If the best way a customer is convinced is to do a POC (Proof Of Concept), then have a checklist of things the customer needs to have ready for a POC.

3. Help your sales person fill up their pipeline in the first 30-60 days. Remove all distractions that your new sales person has by ensuring that they are not responsible for “strategy”, “blogging”, “SEO”, “fund raising”, or any other thing that makes them less productive. Their sole aim should be to sell and to do that they need to build their pipeline.

The last thing you need to do is to have the sales person’s time filled with non-selling activities. They will likely want to help and get excited with all the other value added activity, but that’s the thing you dont need from them. A not so great sales person will likely bring up all these items towards the end of the quarter when they did not make their quota as excuses.

4. Go on the first 5-10 sales calls yourself to help them learn the ropes. If you have hired an inside sales person, make them a “listener” in the first 3 calls, then be an active listener in the next 3 and finally a passive listener in the next 3 calls.

It is important for you to understand if the sales process is different if a founder goes to meet prospects versus a sales person. It is also important to gauge the sales person’s ability to handle objections, prospect questions and also understand the politics of the customers’ organization. It also helps for them to hear you pitch your product, or vision or benefits.

5. Segment the right prospects based on your current customers to ensure they dont chase the difficult or slow to convert prospects. Until the first few deals happen, the sales person will be on edge and they will get frustrated if they make no progress. If they are good, they will likely leave on their own, and you will have to start all over again.

Give them hard qualification criteria on who makes the ideal customer – if that is an early adopter, then you need to define their budget, behavior, title, size, industry, and be as clear as possible.

There are not too many early adopters, so I highly recommend you only give them less than 10-25 prospects (cold or warm) to start with to give them confidence and help you build conviction that they can sell this.

Archives

How “Clustering Illusion” Stalls More #startups Than Any Other Bias

When you are doing your initial customer development, by talking to many potential users, there are many cognitive biases you need to be aware of.

Cognitive biases are tendencies to think in certain ways that can lead to systematic deviations from a standard of rationality or good judgment.

Usually most founders tend to solve problems they have exposure to or those they are aware of, or those they believe to be one that’s a large market. This stems from the “scratch your own itch” phenomenon.

I had a conversation with a founder who is building a consumer internet company, where viral effects of her product determine the growth trajectory more than any other metric. Or so, she had learned from many other founders experiences – both by talking to them and investors in the space.

After 3 months of building her mobile eCommerce product, she and her cofounder launched it in the marketplace. Initial traction was good and trending ahead of their expectations. Many of the early users were impressed with their product selection and merchandise.

Growth after the 4th month though, stalled as they were on the road trying to raise their initial funding. Most every entrepreneur knows that fund raising can be a full time job. In fact I have mentioned several times that fundraising is a poker game more than chess.

When they were trying to show their initial user growth, many investors had the same problem – was their product a trendy, 3-month-uptick or a sustainable-fast-growth business?

After hearing this from the 5th seed investor, they determined that they need to look closer at their numbers, their repeat purchase behavior and address the issue before they were going to raise any funding.

Looking at the initial numbers suggested their they had many buyers who got to know about them through word-of-mouth, and the repeat purchase was high.

She and her cofounder determined that they had to improve their virality coefficient.

This is the bias I see most often: clustering illusion.

The clustering illusion is the tendency to erroneously consider the inevitable “streaks” or “clusters” arising in small samples from random distributions to be statistically significant.

When you have very little data, you have very little data. That’s it.

Don’t make assumptions about the overall market based on very little data.

There are times when you have 60% of the data and you have to make a decision. There are times when you have 30% data and you have to make a decision.

The difference between 30% and 60% is a lot. In fact, most entrepreneurs I deal with confuse having 3% of data with 30% of data.

To reduce clustering illusion the only remedy is to get more data. You will have to run more, smaller, experiments, over smaller periods of time and do it consistently. Make your assumptions, document your hypothesis, but continue to work on getting more data.

Turns out the real problem for our entrepreneur was that the overall market was much smaller, and they found it after 1 year of trying to increase their virality coefficient. They did raise their initial funding, but have since pivoted to expand their merchandise offerings to cater to a larger market.

Archives

How to name your SaaS pricing plans? A primer from 89 examples

There are over 7500 SaaS companies according to angel List. Over the last few weeks I had a chance to review 89 of the companies to understand their free to paid conversion and also a chance to talk to 13 companies. What I learned was that time spent on the pricing page was a key indicator of conversion and you can A/B test your pricing page for colors, position of your highest and lowest prices, number of plans showed, feature listing and your call to action.

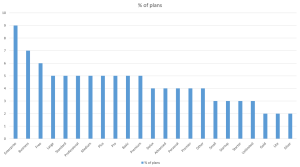

I did notice that of the 89 companies, 82 of them gave their pricing plans “names”. Each plan had a name so their customers could associate the name with the plan. Most (over 80%) used standard and conventional names but it was interesting to see the spread. Here is the data from 89 companies and 251 plans.

The most important points you want to take away are the following:

1. Even though SMB and SOHO (Small Office, Home Office) users are the first few to sign up for a SaaS service, 3 of the top 5 names were named Enterprise and Business and Large. I would imagine this has to do more with the inside out naming (the plan is large or enterprise, not the company buying it).

2. The plans named “Small or equivalent” were largely in the bottom quartile of the distribution. Even though over 70% of companies had 3 plans, only 35% of them named the smallest plan as “Startup”, “Starter” or “Lite”. The most common starting plan was named “Standard”.

3. Of the 20% of companies that used “custom” names like Boutique, Tyrannosaurs, or Garden named all their plans uniquely. The surprising element of the companies that used custom names was that most of them had images to convey the “size” of the plan.

There were some other surprising things I learned as well in my discussions.

1. In naming plans, understanding the end customer’s billing and invoicing was key. Most customers got an email invoice (a few sent PDF invoices) and they would either file them or expense those invoices (if < $50) or would send the invoices to an accounting team.

Ensuring that the “accounting” team did not ask any questions was the consistent mention among 3 of the startups with custom names for plans.

2. Naming the plans to support your payment gateway is also critical. Getting too cute with names means the payment gateway will support a higher refund request that were marginal.

3. Many of the companies had to setup standard names so their marketing and product management teams could do better analytics and research on the backend, consistent with their reporting. Surprisingly, if the names were “standard” the companies found it easier to have a conversation to understand conversion rates, pricing options and changes with their finance teams, design teams and other outsourced companies as well.

Archives

Creating Artificial Constraints as a Means to Innovation

Many of the entrepreneurs I know have created new innovative startups thanks to real constraints they had. For example, I was hearing AirBnB’s Brian Chesky, on the Corner Office podcast and he mentioned that when he and his cofounder were trying to get some money to get started and the only way to keep afloat was to “rent” their air bed they had in their room. That, then led to Air Bed and Breakfast, which is now AirBnB.

This was a real constraint they had – no money to “eat” so they had to make it happen somehow.

I have heard of many stories of innovation where in the protagonists had real constraints of either financial, technology, supply, demand, economic, social or any number of other characteristics.

The interesting story that I have also recently heard of how Facebook has “pivoted” from being a desktop offering to getting a significant part of their revenue from mobile is how they were given the arbitrary constraint of only accessing Facebook via the mobile phone.

So there are ways that you can create “artificial” constraints to force innovation to happen.

Most larger companies and some smaller ones as well, have to constantly find ways to create artificial constraints – to find a way to innovate and be more be a pioneer.

While some constraints are good – lack of funds at the early stage for example and lack of resources, there are entrepreneurs that are stymied by these constraints and those that will find a way to seek a path to go forward.

I think this is a great way for you to think about innovating in a new space. If you have constraints, find a way to use it to your advantage.

-

Business2 days ago

Business2 days agoWhat I Learned in My First Month of Running a Startup Accelerator

-

Business3 weeks ago

Business3 weeks ago5 Profitable Digital Business Ideas, Increase Your Income!

-

Archives3 months ago

Archives3 months agoHow Can You Tell If An Angel Investor Is “real” Or “fake”?

-

Business1 month ago

Business1 month agoIndividually Proficient, Collectively Efficient; Why Your First Hire Matters

-

Business4 hours ago

Business4 hours ago6 Affordable Co Working Space around the Globe

-

Business4 hours ago

Business4 hours ago6 How to Make a Business Presentation More Relatable

-

Politics1 month ago

Politics1 month agoPrediction of Global Economy in 2024, Indonesia The First ASEAN Country Most Confident to Create This Program

-

Archives1 month ago

Archives1 month agoHow Accelerators Make Money To Manage Operating Costs